How do you get bankrupt?

Insolvency – a person who cannot pay his debts, even based on his expected income. Usually he or the creditor files for bankruptcy. The main goal is to enable debtors to turn over a new leaf. In order to file for bankruptcy, forms must be filled out and submitted to the official receiver, who does two things:

- checks that the application has been filled correctly;

- Ensures that the deposit is paid or settled in the amount of NIS 1,600. Whoever pays the fee is the debtor!

More than a decade ago, they reached an arrangement in the High Court of Justice that determined that anyone who had been determined by the Legal Aid Bureau in the Ministry of Justice was entitled to receive legal aid, the state would interactively fund the deposit. In other words, the state pays the deposit in the amount of NIS 1,600, and if enough funds accumulate out of the monthly payments and the debtor’s assets, then the deposit is returned.

Convocation Order

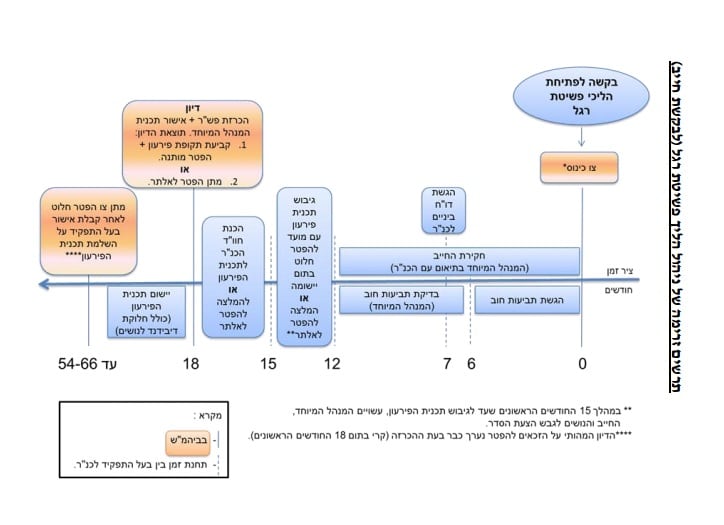

After filing for bankruptcy and after the official receiver’s response is given, the court issues a receivership order, usually within a week or two of completion of the application. The receivership order, including the order, prohibits creditors from taking any action against the debtor. The order gives the debtor protection from his creditors.

As part of the response to the receivership order, the official receiver appoints a special manager who is an external attorney who examines the circumstances under which the debts were created. In order for the debtor to remain bankrupt, the special manager must be convinced that the debts were created in good faith and that the debtor is proceeding in good faith. What does it mean? There are the obvious things: neither fraud nor theft, no smuggling of assets (for example, transferred the apartment to children, transferred funds to an account abroad). There are less obvious things: for example, someone who was in prison for stealing money and served his sentence, or someone who was tried for rape for which he was imprisoned. There is an issue here with a man who has already served his sentence for society.

Once a receivership order is issued, creditors have the right to file a debt claim. The fact that he has a receivership order is published and is obligated to send the receivership order by mail to creditors.

After the Order of Convocation

The debtor must submit monthly reports of income and expenses every month or two during the duration of the procedure. One of the goals is to make sure that the debtor manages his household in a balanced manner and does not create new debts. In September, 2013, a reform was carried out in the activity of the official receiver, according to which the hearing is scheduled about a year and a half after the convening order. During the period, the debtor is investigated, the debt claims are examined, and one of the following three options is recommended:

- Cancellation of proceedings – if the debtor did not create the debts in good faith or he does not submit the forms, or does not make payments, or creates new debts.

- Dismiss immediately – Roni After 18 months, the proceeding ends and the debtor receives the dismissal. The deceased relieves the debtor of his debts. The immediate exemption is intended for people who do not have property, or even if they make every effort, will not be able to pay even a little of their debts.

- Repayment plan – the special manager examines together with the debtor (but not necessarily with his consent) all the debtor’s property, including his current and potential earnings, and formulates a repayment plan that is supposed to be completed within three years from the end of the examination (4.5 years after the application is submitted), in which the debtor returns what he can, and then he receives discharge – his debts are erased.

The meaning of exemption is exemption from all obligations. The exemption does not apply to alimony and fines to the state – these obligations are not erased.

Advantages and disadvantages of the bankruptcy procedure

There is interest on arrears of execution. From the stage when there is a receivership order, all interest stops. As mentioned above, every creditor has the right to file a debt claim, but there are creditors who do not file and will not be entitled to any amount from the bankruptcy fund. The Special Director examines the debt and has the authority to reduce the debt if there is a legal justification for doing so, including the rejection of the entire debt.

During the bankruptcy proceeding (from the receivership order until receipt of the discharge) the creditors cannot take any action against the debtor.

The receivership order imposes restrictions to require:

- prohibition on leaving the country;

- It is forbidden to use a credit card and to use credit in general, but it is permissible to use a debit card, which does not allow credit card purchases

- It is permissible to open a bank account, provided that the account is managed only plus, from the receivership order until receipt of the dismissal;

- Providing credit to the debtor after the conclusion of bankruptcy proceedings is possible, but it is likely that the bank will require a higher interest rate in order to insure itself.

The starting point of the official receiver when examining an application is to impose on the debtor no less than NIS 500 per month. However, each application is examined on its own merits, in accordance with all the debtor’s data, including the debtor’s age, health condition, marital status, etc.

When the proceedings regarding the debtor do not end on the date of the hearing (immediate dismissal or cancellation of proceedings), the debtor is declared bankrupt and a trustee is appointed. In the vast majority of cases, the trustee is someone who has served as a special manager. By law, the debtor’s assets are vested in the trustee. He may realize the debtor’s assets, with the approval of the court.

After the dismissal, there is often a black spot left in the debtor’s name as far as the banking system is concerned. According to the law, up to seven years after the dismissal, banks are allowed to refer to the fact that the debtor was in bankruptcy. To the best of my knowledge, in practice, the banks do not ignore the exemption {and remember this to be charged beyond seven years}.

At the beginning of September, 2015, the dismissal process entered the Execution Office.

Is it right for a couple to go into bankruptcy together?

Suppose the business is the husband’s. When the debts are not the wife’s, collection proceedings cannot be taken against her, even though in practice the burden of the debts falls on her as well (unless the husband enters bankruptcy proceedings). When determining the monthly payment, the household income – that is, that of the spouses – is taken into account. If he receives a discharge, then creditors will not be able to apply to her, except for debts that were registered in her name. If the couple has joint debts, then both can enter the process of bankruptcy.

Types of creditors

Secured creditors

Like a mortgage, a bank that gave a mortgage to finance a purchase (car, house) and then a lien of the property was created. This creditor can also act outside the bankruptcy proceedings.

Creditors in Kadima Law

That means charging before everyone else. The first debt to be paid will be wages, followed by deductions from labor wages. The third level of the law of precedence includes payments to income tax and VAT (one year out of the tax years, at the choice of the tax authorities), rent and municipal taxes (from the year preceding the year in which the debtor entered bankruptcy) and alimony.

When Social Security makes the payments (whether wages or alimony), Social Security “steps into the shoes” of that creditor and is entitled to a forward judgment.

When a debtor owes a large alimony debt, this is a reason for granting the exemption immediately, since on the one hand all payments will go to the person entitled to alimony (because this is a law of precedence), but since the discharge does not apply to a maintenance debt, the cancellation of the proceedings will

not

harm the person entitled to alimony, and because of the amount of the debt, the other creditors will not receive anything anyway.

The debtor’s former spouses also have standing in the proceeding in relation to their own alimony or that of their children; During bankruptcy, they have the right to go to court and receive alimony. When the family court determines alimony, it considers only the right of the children and the ability of the father, and the main consideration is the best interest of the child. When the debtor enters bankruptcy, the court should also consider the right of creditors, and the court can determine a lower amount. In any case, the alimony debt continues to accumulate during this period, and as stated, there is no exemption from it.