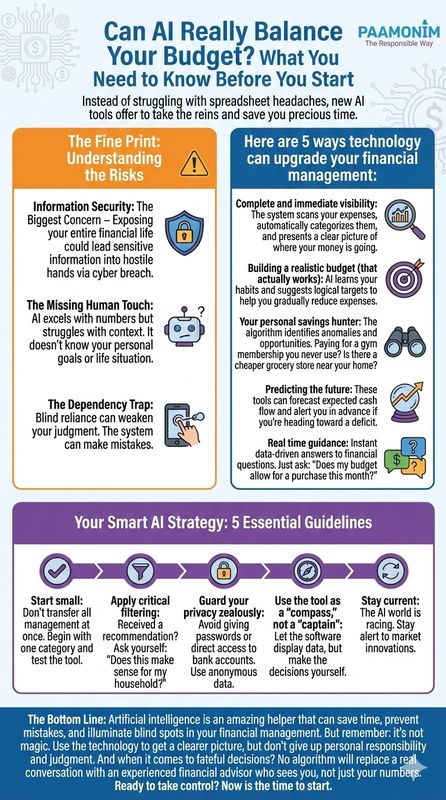

Instead of struggling with spreadsheet headaches, new AI tools offer to take the reins and save you precious time. Here are 5 ways technology can upgrade your financial management:

Complete and immediate visibility: The system scans your expenses, automatically categorizes them (food, transportation, entertainment), and presents a clear picture: where exactly your money is going.

Building a realistic budget (that actually works): Unlike a “dream budget” that nobody sticks to, AI learns your habits and suggests logical targets that help you gradually reduce expenses.

Your personal savings hunter: The algorithm identifies anomalies and opportunities. Paying for a gym membership you never use? Is there a cheaper grocery store near your home? The system will surface these insights.

Predicting the future: Instead of being surprised at month’s end, these tools can forecast expected cash flow and alert you in advance if you’re heading toward a deficit.

Real time guidance: Wondering whether to buy a new television? You can simply ask the chat: “Does my budget allow for a purchase this month?” and receive a data driven answer in seconds.

The Fine Print: Understanding the Risks

Despite how rosy everything sounds, entrusting your financial information to a machine requires extra caution. Before starting, it’s important to understand the dangers:

Information Security: The Biggest Concern

When you connect an external app to your bank account, you’re exposing your entire financial life. A cyber breach of the app’s database could lead your most sensitive information into hostile hands.

Pro tip: Don’t give direct access to your bank account or credit cards. Prefer uploading spreadsheet files or entering data manually.

The Missing Human Touch

Artificial intelligence excels with numbers but struggles with context. It doesn’t know you’re saving for a wedding, supporting an aging parent, or planning a career change. Its recommendations are purely mathematical, and sometimes that’s not enough.

The Dependency Trap

Blind reliance on the app could weaken your own judgment. Remember that the system can make mistakes (for example, categorizing a one-time gift as a regular monthly expense) and lead to incorrect conclusions.

Your Smart AI Strategy: 5 Essential Guidelines

Want to enjoy the technology without getting burned? Adopt these guidelines:

Start small: Don’t transfer all your management at once. Begin with one category (for example, “food”) and test the value the tool provides.

Apply critical filtering: Received a recommendation from the AI? Excellent. Now ask yourself: “Does this make sense for my household?”

Guard your privacy zealously: Avoid giving passwords or direct access to bank accounts. Use anonymous data whenever possible.

Use the tool as a “compass,” not a “captain”: Let the software display data and alert you, but make the decisions yourself.

Stay current: The AI world is racing forward. A tool that was excellent a few months ago might be outdated. Stay alert to market innovations.

The Bottom Line

Artificial intelligence is an amazing helper that can save time, prevent mistakes, and illuminate blind spots in your financial management. But remember: it’s not magic.

Use the technology to get a clearer picture, but don’t give up personal responsibility and judgment. And when it comes to fateful decisions? No algorithm will replace a real conversation with an experienced financial advisor who sees you, not just your numbers.

Ready to take control? Now is the time to start. Choose one tool, enter basic data, and discover where your money is hiding.